반응형

컵 앤 홀더 (Cup and holder) 혹은 컵 위드 핸들 (Cup with handle) 패턴에 관한 좋은 글이 있어서 가져와본다. 컵앤홀더 혹은 밥뚜겅이라는 불리는 패턴은 개인적으로 신뢰하는 (물론 다 맞는 건 아니다. 주식시장에선 그런 건 없다) 패턴인데, 이런 패턴이 어떨 때 좋은지에 대한 그림이 밑에 있다.

추가적으로 설명하자면, 컵 바닥의 길이가 길면 좋지만, 너무 길면 (1년 이상) 오히려 이 주식은 장기 우하향하는 것으로 보아야 한다. 성장 가능성이 있으면 바닥에서 반등이 서서히 일어날 것이고 (서서히가 중요하다. 너무 급박하게 오르면 다시 급격하게 내려갈 가능성이 있음), 이후 손잡이 패턴의 모양이 어떤 식으로든 만들어지는 게 좋다. 하지만 경우에 따라선 기세가 너무 좋을 때 손잡이가 거의 만들어지지 않고 올라갈 수도 있긴 한데 그런 경우는 꽤 드문 케이스다. 왜냐하면 대부분 사람들이 전고점 근처에서 팔려고 하는 심리가 강하기 때문이다.

컵앤홀더 관련 그림 및 설명을 적어본다. 참고로 이 자료는 tradingview.com에서 가져왔다.

One of the most popular figures of technical analysis among day traders is a cup with a handle.

This figure is so popular due to its fairly clear and specific rules, in addition, the figure gives an excellent risk/profit ratio.

How to identify the model?

The formation of the model is divided into 4 stages:

1. The price has been rising for some time;

2. After the correction begins to about half of the previous growth – this is how the bottom of the cup is formed;

3. Then the price starts to rise to the previous maximum and turns down, failing to break through the resistance – this is the handle;

4. Then the price goes to break the maximum again, after which it goes even higher, approximately to the height of the cup depth.

How long does the model take to form?

A cup with a handle is formed from a few weeks to six months – that is why it is suitable for a long-term trader. It is very important to form a handle, which should be completed within a month, otherwise it may mean that the upward movement is weak and there may not be a breakdown.

Characteristics of the cup and handle

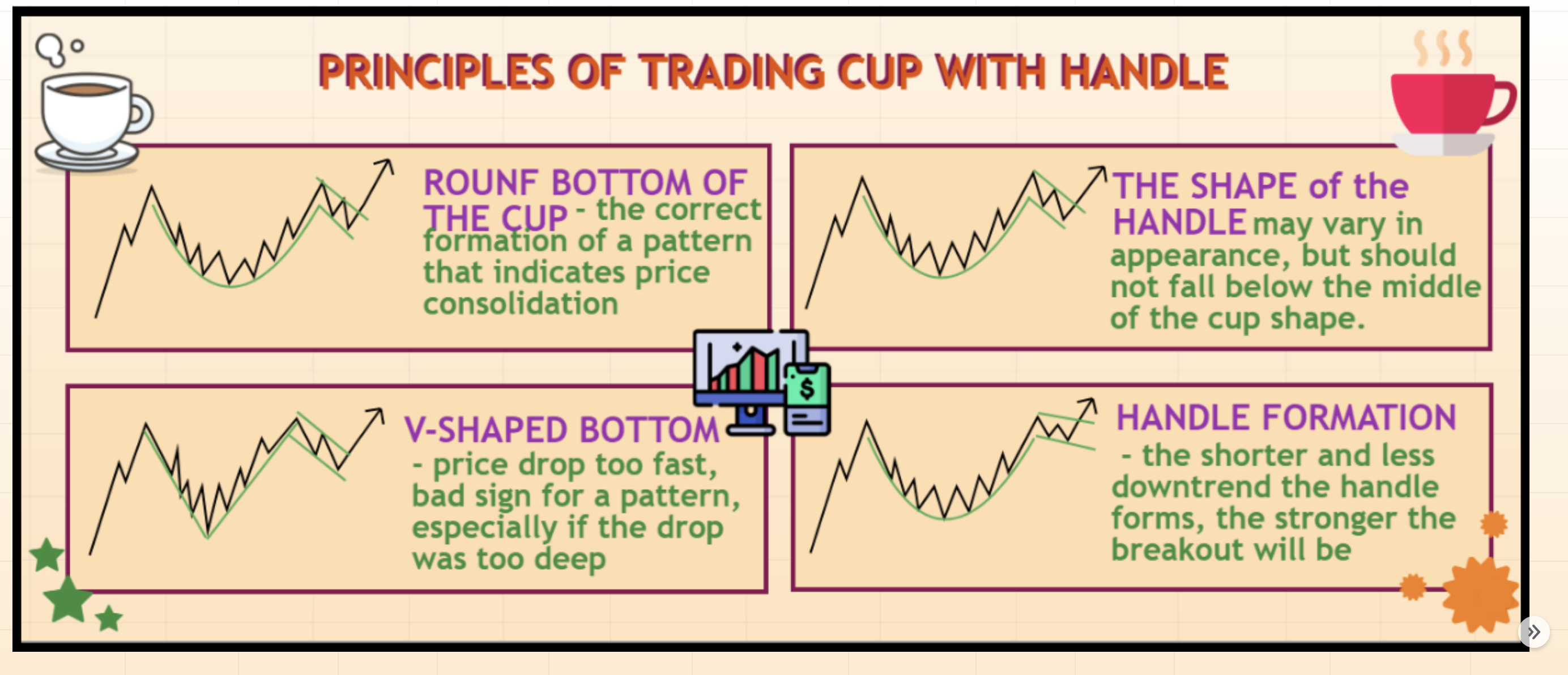

A round cup indicates consolidation, whereas a V-shaped cup indicates a too sharp reversal, which is not good.

The depth of the cup should be equal to one-third to one-half of the previous upward growth.

The handle should not fall more than one-third of the cup gain. In addition, a short and weak drop in the handle signals that a breakout may be very bullish .

How to trade?

Entrance

The best entry point is the handle. At the moment, the price is falling and forming a downtrend, the trader should enter the transaction when the price breaks through this downtrend.

Profit goals

To determine the goal, you need to measure the distance from the bottom of the cup to the beginning of the handle – this distance is above the breakdown of the maximum and will be our goal.

In addition to the main method of determining the goal, you can use Fibonacci lines – the 100 percent line is considered a conservative goal, and the 162 percent is considered an aggressive one.

Stop Loss

No matter how well the figure is formed, do not forget about the risks and the fact that the price can turn against you at any moment.

Set the stop loss is set below the minimum of the handle, then you will protect yourself from large losses.

Conclusions

This figure is not in vain so popular, it is very profitable and has clear rules, which makes it easier to work. Be patient, because the figure is formed for several weeks, or even months. Do not go too early, without waiting for the formation of the cup and handle . Premature entry promises losses.

Who knows how to wait - gets everything!

Good luck!

This figure is so popular due to its fairly clear and specific rules, in addition, the figure gives an excellent risk/profit ratio.

How to identify the model?

The formation of the model is divided into 4 stages:

1. The price has been rising for some time;

2. After the correction begins to about half of the previous growth – this is how the bottom of the cup is formed;

3. Then the price starts to rise to the previous maximum and turns down, failing to break through the resistance – this is the handle;

4. Then the price goes to break the maximum again, after which it goes even higher, approximately to the height of the cup depth.

How long does the model take to form?

A cup with a handle is formed from a few weeks to six months – that is why it is suitable for a long-term trader. It is very important to form a handle, which should be completed within a month, otherwise it may mean that the upward movement is weak and there may not be a breakdown.

Characteristics of the cup and handle

A round cup indicates consolidation, whereas a V-shaped cup indicates a too sharp reversal, which is not good.

The depth of the cup should be equal to one-third to one-half of the previous upward growth.

The handle should not fall more than one-third of the cup gain. In addition, a short and weak drop in the handle signals that a breakout may be very bullish .

How to trade?

Entrance

The best entry point is the handle. At the moment, the price is falling and forming a downtrend, the trader should enter the transaction when the price breaks through this downtrend.

Profit goals

To determine the goal, you need to measure the distance from the bottom of the cup to the beginning of the handle – this distance is above the breakdown of the maximum and will be our goal.

In addition to the main method of determining the goal, you can use Fibonacci lines – the 100 percent line is considered a conservative goal, and the 162 percent is considered an aggressive one.

Stop Loss

No matter how well the figure is formed, do not forget about the risks and the fact that the price can turn against you at any moment.

Set the stop loss is set below the minimum of the handle, then you will protect yourself from large losses.

Conclusions

This figure is not in vain so popular, it is very profitable and has clear rules, which makes it easier to work. Be patient, because the figure is formed for several weeks, or even months. Do not go too early, without waiting for the formation of the cup and handle . Premature entry promises losses.

Who knows how to wait - gets everything!

Good luck!

반응형

'주식일반' 카테고리의 다른 글

| 한국주식 장기투자는 미친 짓이다 #3 (0) | 2022.01.09 |

|---|---|

| 충격에 강한 주식들 (0) | 2022.01.06 |

| 주식, 채권, 기준금리의 관계는 생각보다 복잡하다 (0) | 2021.12.17 |

| 기술적 분석은 이차적인 수단, 차트 중요하나 집착하지 말자 (0) | 2021.12.17 |

| 내가 지인들에게 이 사이트를 알리지 않는 이유 (0) | 2021.12.16 |