반응형

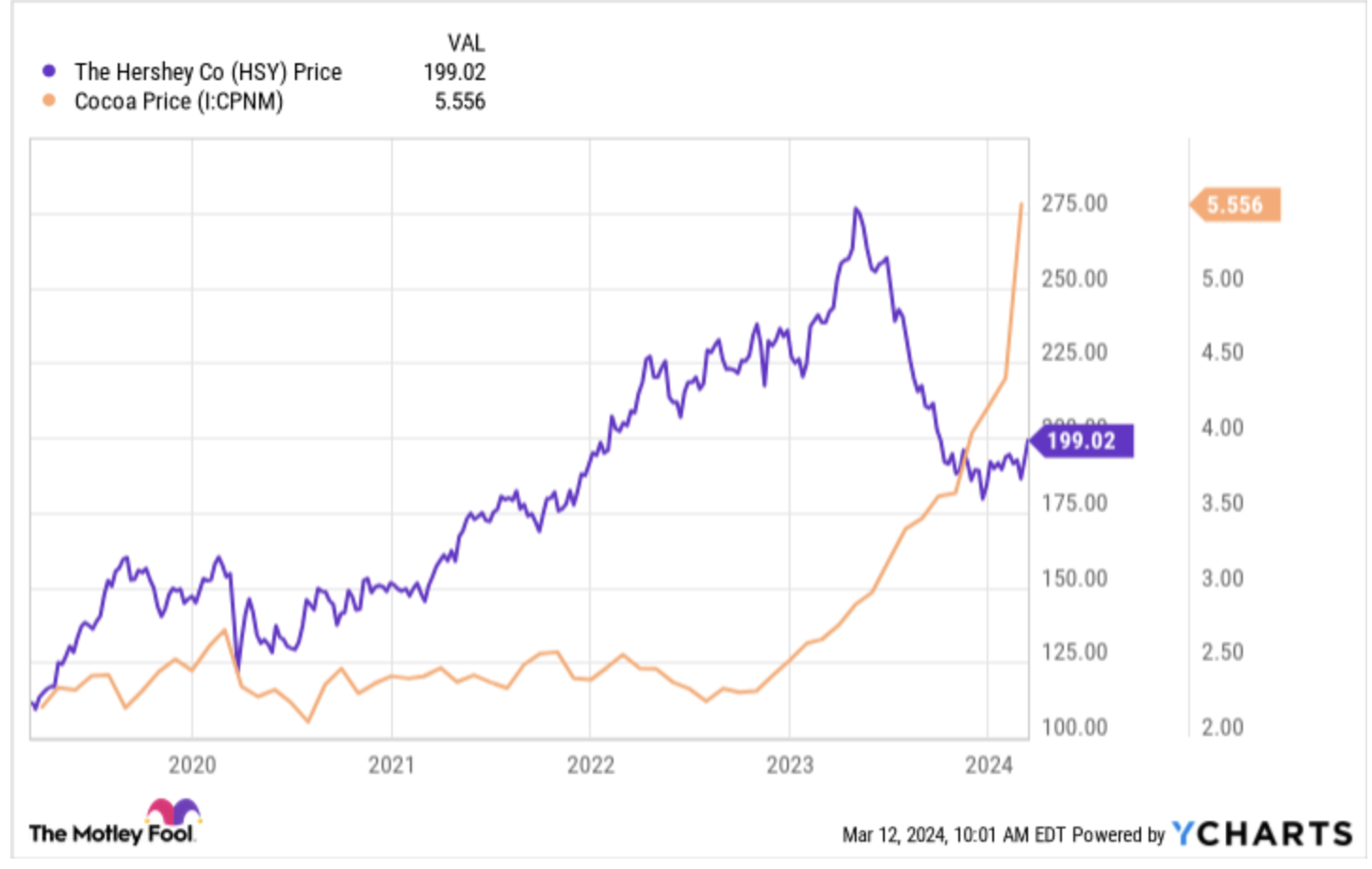

일반적으로 코코아 가격이 오르면 초콜렛 회사의 가격은 떨어진다. 장기적으로 보면 그렇다. 아래 그림처럼 코코아 가격이 오르기 시작한 2023년부터 허시 주가는 박살.

그러나 단기적으로는 허시 주가가 안정되는 느낌 이유는 다음과 같다.

1) 일단 너무 빠졌다.

2) 코코아 양을 줄이든지 가격을 올리든지 크기를 작게 줄이든지 허시가 취할 전략은 많다. 설탕 많이 때려넣어도 되고.

3) 코코아 가격이 좀 잡히지 않을까?하는 기대감.

아래는 seekingalpha 기사 내용이 허시가 취할 수 있다는 전략이 많다는 내용.

| What to do with the cocoa situation? Usually, when there is a commodity shortage due to great demand, the producer companies make tons of money because revenues go significantly up while operating expenses remain stable. This is the case with commodities like oil, potassium, and uranium. In the case of Hershey, chocolate is not as fundamental to society as oil or gas might be, although some people would disagree. This is the reason why its demand and, more specifically, sales volumes in HSY are beginning to decline quickly with a cocoa price increase. Nonetheless, this shortage is not caused just by great demand but also by a lack of supply. In this case, the sellers have restricted revenues because there is not enough material to sell, such as processed cocoa. Therefore, a cocoa shortage caused by the weather is more similar to the semiconductor shortage that the car industry experienced from 2020 to 2022, limiting car production and sales, although margins expanded. In Hershey’s case, the likely outcome could be what the management expects: a moderate increase in revenues, followed by slight margin contraction and stable EPS. When this kind of shock occurs, companies tend to take two actions before volume decreases significantly. First is that products would now include less cocoa, likely increasing the amount of sugar and sugar replacements to increase the cocoa flavor. Secondly, products might continue with their cocoa density but would be slightly smaller at the same price. These measures are relatively decently received by the consumer staples markets, especially if the entirety of the industry is implementing them. A particularly good adoption of this happened when Coca-Cola, realizing the clients did not need the larger sizes necessarily, while increasing the margins. This phenomenon is also unofficially referred to as shrinkflation. |

반응형